Fintech Lists Galore - So where are the Badass Women?

City A.M. has published the first Powerlist for Fintech and the result are in. Canary Wharf is full of the real movers and shakers in fintech.

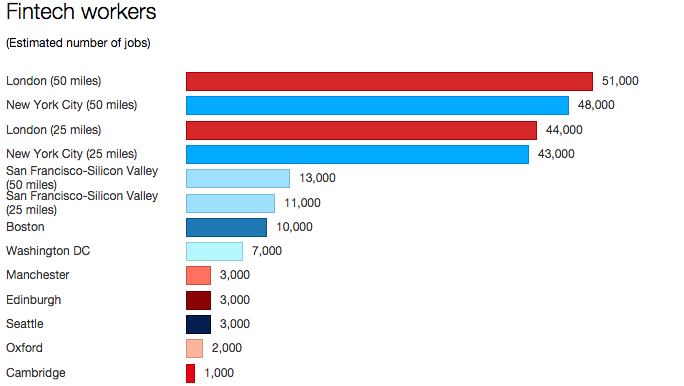

To paraphrase Nutmeg‘s Nick Hungerford: if you dropped Stanford University into London, it would be the fintech centre of the world. And when you look at the statistics, it becomes clear why dismissing the motherland of Silicon Valley and embracing London’s revolutionary heartland makes total sense. Yet even with 44,000 people working in the fintech capital, there remains a curious absence of a certain kind of entrepreneur: the women in fintech.

A worrying lack of women are part of the fintech revolution, especially in senior level positions.

Statistics dissected by Anna Irrera, a pioneering writer on fintech, show that none of the top twenty European fintech companies that received the largest venture capital investments in 2014 had a female chief executive. Moreover, only 9 of 114 key executives at those firms were women. In the top fifty companies, there are only 11 women out of 222 key executives. And only one female CEO.

Fintech’s extraordinary growth is largely due to its perfectly balanced ecosystem. London has a dense population of innovators, a pipeline of technologically driven talent, as well as a core of highly collaborative entrepreneurs supported by a sympathetic government. Plus investors are interested enough to actually invest, meaning London alone has raised more money for fintech than the rest of Europe. The industry is now worth over £20billion. And London is the biggest global centre for financial technology based on the number of people employed in the industry.

The benefits of gender diversity in the development of any business are already evidenced and championed. Sarah Turner of Angel Academe, emphasised the need for ‘diversity throughout the entrepreneurial ecosystem’. Yet, put simply, this does not yet exist. The ‘disruptors’ seem to be just as traditional in their gender biases as any other part of finance.

#Fintech: New sector, same old problem http://t.co/LEyDnpMcP9 The 0% club pic.twitter.com/EDUQwYUg4F

— Anna Irrera (@annairrera) February 20, 2015

What is reassuring is that, for a relatively young industry, it is also one of the most pioneering.

The inaugural Innovate Finance Global Summit, which took place on March 10th 2015, was the brainchild of a board of women CEOs. The Women in Fintech supplement was released to coincide with the summit. Containing twenty pages dedicated to senior-level women, it listed the women who are not just part of the fintech sector, but defining it.

Software engineer turned investor, Eileen Burbidge, has used mentorship, investments and co-working to become a powerhouse behind dozens of burgeoning fintech ideas. This includes both Transferwise and DueDil. Which is pretty impressive considering their CEOs are both listed on City A.M’s fintech Powerlist. Just below her of course.

Gemma Godfrey, who might well be the most popular #business influencer on social media and a quantum physicist, is also the Head of Investment Strategy at Brooks McDonald. Her emphasis on simplicity and open communication ensures her popularity, but it also means she’s right up-to-the-minute with the fintech scene which thrives on exactly those qualities.

A true innovator is Julia Groves, CEO of the crowd financing platform for renewable energy projects, Trillion Fund. Trillion Fund are not only innovating the sustainability landscape, but also the conversation around crowd funds and alternative finance options. Others include Monitise’s Elizabeth Buse, and Seedr’s Karen Kerrigan, both of whom are making a tangible difference to the way we think about money in the digital world.

And then there’s Claire Cockerton. From start-ups to global enterprises, Cockerton’s brainchild has fully established the Silicon Roundabout and it’s voice. Innovate Finance, a cross-sector, member-driven organization, it is founded on the desire to see the UK boom as a global financial center. It also Finance demonstrates just how fintech is pulling in the talent.

Yet Cockerton is the one who said that ‘30% is the first step’ for women in fintech. That it is beyond time for aspiring women to take that step.

Because the continued success of Britain’s fintech sector depends on talent wanting to come into it.

As an industry, it is growing so fast that to sustain its momentum it needs a pipeline of creative, intelligent, passionate people.

Diversity is crucial to this.

Women are crucial.

And with so few women recognised at the top (only 8 of 61 are women on the City A.M. Powerlist), it’s time for girls to believe that they can do it.

If London is the blueprint for fintech, it’s time that it became the blueprint for gender equality in finance as well.

Profiling 100 of the Amazing Women Working in #Fintech http://t.co/7vUBQwes83 #startup #technology pic.twitter.com/x7ZJt45fXD

— Frugalis.ca (@frugalis) March 23, 2015

Je serai poète et toi poésie,

SCRIBBLER

Nice Information!!

ReplyDeleteIt is very helpful information about Tax It Here. Thanks for sharing

first Fintech Startup